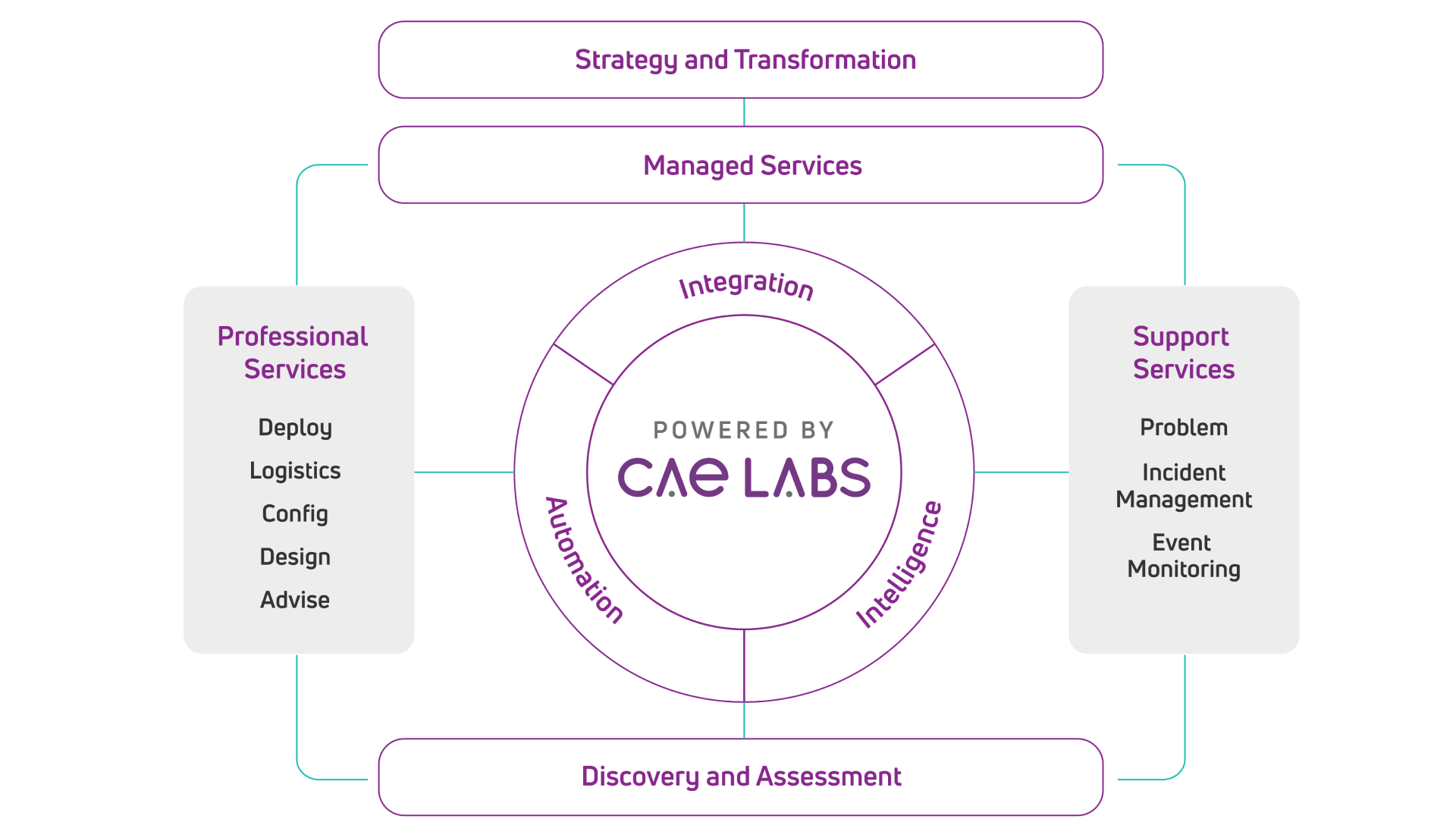

Our Services

A complete range of service and expertise designed for a digital world

Better Service - Reduced Cost

We help businesses transform through technology, and provide value-added support to deliver more good days. We do this by listening to your needs and understanding them, so you achieve the outcomes you need.

Enabling flexibility in organisations and driving increased productivity requires more than modern hardware and technology. Businesses need access to specialist skills to deliver effective user experiences and tools through fast deployment programmes.

That's why we provide IT infrastructure that connects, secures and transforms your business, improving the way you work and enabling future growth.

Strategy & Transformation

Plan your goals around the outcomes you want to achieve. We’ll work with you to create a blueprint for your transformation strategy.

Managed Services

Let CAE take care of it. Bringing all the professional support you need into one package, we’re your trusted partner for managed IT services.

Professional Services

We're project specialists, providing professional services for highly technical and complex IT projects.

Support Services

Seamless support, fast resolution. With responsive and proactive technology support services from CAE, your IT environment is in capable hands.

Discovery & Assessment

Audit, analyse, consolidate. Get the full picture about your existing hardware and software assets and build a foundation for the future, with CAE.